WAY | Bot

Descrição

Trading Way Neural Network Functionality: A Detailed Description of AI Forecasts and Signals

Trading Way is a comprehensive solution for traders built on the power of artificial intelligence. Our neural network analyzes the market solely based on technical analysis, using a comprehensive dataset and advanced algorithms. Let's take a closer look at the key features.

1. AI Forecasts and Trade Filtering: Your Analytical Assistant

This feature allows you, as a trader, to actively interact with the AI to obtain analytical information and test your hypotheses.

Process:

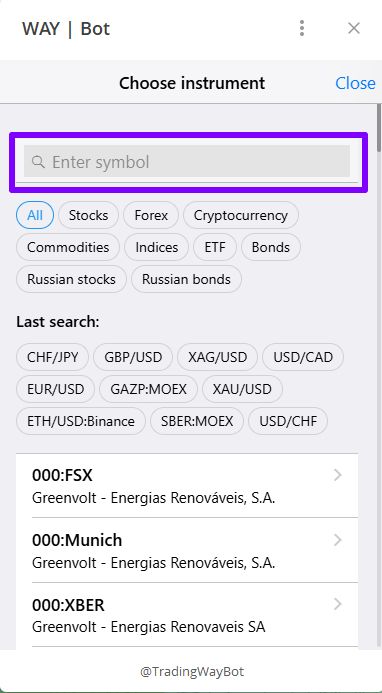

Your Request: Select the instrument you are interested in (e.g., BTCUSD, EURUSD) and set the parameters:

Timeframe: Hour, day, week, etc.

Data Search and Processing:

Access to Data Centers: The neural network gains access to extensive historical and current datasets collected from reliable financial platforms. This data is exclusively for technical analysis (charts, volumes, indicators).

Best Method Selection: The AI uses over 300 different technical analysis methods (moving averages, RSI, MACD, patterns, wave analysis, and many others). Instead of applying everything, the neural network intelligently selects the most appropriate methods for your request, the current market situation, and the specific instrument. This selection is based on the learning speed and effectiveness of each method under the given conditions.

Real-Time Query: After the initial selection, the AI makes an additional real-time query to obtain up-to-date data on:

Trading Volume: This is critical for determining the strength of movements and confirming trends.

Price Dynamics: Recent changes in real time.

Probabilistic Model Building:

Data Cluster Analysis: The neural network processes all the received information, identifying data clusters – groups of related parameters that indicate specific market conditions.

Model Generation: Based on the analysis, the AI builds probabilistic models of price movement. This is not a hard and fast forecast, but a mathematically sound prediction of the most likely scenarios, including:

Direction: Rise, fall, or flat.

Potential Amplitude: Expected movement in points or percentages.

Performance Time: When this movement is likely to occur.

Trade Filtering: The AI filters potential trades based on your parameters. It filters out situations that do not meet the specified risk, probability, or timeframe criteria.

Result Delivery: You receive:

Price Movement Forecast: A graphical representation of the likely scenario.

Key Points: Identification of probable entry points, take-profit, and stop-loss levels.

Probability of Execution: The AI's percentage of confidence in this forecast.

Risk to Reward Ratio: An estimate of the potential profit.

2. "AI Signals" Function: Automatic Search for the Best Opportunities

This function is the heart of Trading Way, designed to automate the process of finding profitable trades, minimizing your time and emotional involvement.

Process:

Parameter Settings (Your "Filter"):

You set the neural network's strict parameters that a potential trade must meet:

Risk to Reward Ratio: For example, 1:3, 1:5.

Minimum Probability of Success: For example, 70% or higher.

Preferred Timeframes: Short-term, medium-term.

Instruments: You choose which assets the AI will search for signals on.

Continuous Market Monitoring:

Continuous Analysis: The AI continuously scans selected instruments on specified timeframes, using the full arsenal of technical analysis methods (over 300).

Finding the Perfect Moment: The neural network actively searches for market situations that precisely match your configured parameters. These could include:

Breakthroughs of key levels with volume confirmation.

The formation of specific chart patterns.

Signals from a combination of indicators indicating a high probability of trend continuation or reversal.

A combination of volatility and other factors.

Probability Model Building and Filtering:

Dynamic Model Building: When the AI detects a potentially interesting moment, it immediately builds a probability model of price movement specifically for this situation.

Parameter Validation: This model and the situation itself are then rigorously filtered according to your specified criteria (risk/reward, probability, timeframe).

Real-Time Volume Processing: The AI takes into account current trading volumes to ensure that the move is confirmed by market participant activity. Signal Generation and Sending:

Measured Setup: If the situation successfully passes all filters and the model shows a high probability of a successful outcome with a favorable risk-to-reward ratio, the AI generates a ready-made trading signal.

Signal Details: The signal contains all the necessary information:

Instrument.

Recommended entry point.

Stop-loss.

Take-profit (or multiple targets).

Predicted likely move.

Probability of a successful outcome.

Risk-to-reward ratio.

Key levels.

Notification: You receive this signal in a convenient format (for example, via a Telegram bot) to decide whether to enter a trade.

Key Advantage:

Unlike requesting a forecast yourself, where you are searching and may miss optimal conditions, the AI Signals feature ensures that you receive a notification exactly when the market has formed the best conditions based on your criteria. This eliminates impulsive decisions, increases discipline, and allows you to enter trades with a calculated risk and a high probability of success. AI becomes your reliable filter against market noise and your guide to quality trading opportunities based solely on technical analysis data.

Iniciar app

Idiomas da interface

ENRU

Desenvolvedor

⚡️ Confirmado pelo desenvolvedor Este emblema significa que o desenvolvedor reivindicou a propriedade deste aplicativo e nos forneceu capturas de tela, descrição e outras informações.

FindMini.app não é responsável por nenhum dos aplicativos do catálogo. Ao usar este aplicativo, você assume seus próprios riscos.